Hey everyone,

The scariest business failures aren't caused by stupidity.

They're caused by smart people acting rationally… in ways that doom the company.

I did a deep dive on Kodak recently. They invented the digital camera in 1976. And they knew exactly when the disruption was coming, with 20 years of runway.

And they still went bankrupt.

So today, I’ve got three things for you:

A warning about incentives

An easy gut-check exercise for your company

Three ways to protect those essential “tough calls”

Let’s do it.

I’m looking for a CEO → Are you an accounting or audit pro who wants to be a CEO? With equity, salary, and reduced downside risk? And more leads than you can handle?

I have a founding CEO role available. Reply to this email for more info!

A warning about incentives

I’ve written plenty about incentives before, so I’ll keep this brief.

In the 70s and 80s, Kodak film had 80% profit margins. Digital cameras had maybe 5%.

In the short term, the call was obvious. What’s more, middle managers were bonused on this year's profits. Senior executives needed to hit quarterly targets. The board's job was to protect shareholders today, not shareholders in 2015.

So when an engineer showed them the future they’d invented, it was totally rational to say, “Cute experiment. Keep it to yourself."

This might be happening at your company. You might not even see it.

Ask yourself:

What are your people actually rewarded for? Revenue? Profit? Growth? Retention?

Are those incentives aligned with where your business needs to be in 3–5 years?

Who in your company is motivated to tell you uncomfortable truths about the future?

In my experience, you need at least one person whose job is to think in decades, not quarters.

It’s not about intelligence.

If everyone's comp is tied to this year's numbers, you're structurally incapable of betting on tomorrow.

One gut-check exercise

When Kodak tried to adapt (too late), they launched digital cameras and bought a photo-sharing site.

It seemed reasonable to look for businesses adjacent to what they already did.

Their competitor Fujifilm took a different angle: "What specific competitive advantages do we have that could win in other industries?"

Fujifilm turned their 80 years of gelatin expertise and knowledge of oxidation into a successful skincare brand.

Meanwhile, Kodak's healthcare imaging division got sold off for cash.

For your business, that means: When you're facing a market shift, don't ask "what's adjacent?" Ask "what do we actually do better than anyone else?"

Here's a framework:

List your company's genuine competitive advantages (capabilities, not products)

List industries where those capabilities would create unfair advantages

Test whether your team can articulate these advantages without mentioning your current product

If your team can only describe your advantages in terms of what you sell today, you're vulnerable.

Last year, a HoldCo Conference attendee told us his ticket paid for itself in one conversation.

Over dinner, he was talking deal structures with the guy across the table. That guy with an operator who'd just exited a portfolio company.

The operator shared a specific earn-out structure that protected downside while keeping the seller motivated.

Three months later, our attendee used that structure on his own deal. Saved $200K in negotiation and avoided $150K in potential earnout issues.

$350K impact. One conversation.

Get in the room this February.

Protect the ability to make hard calls

Fujifilm was willing to accept short-term pain for long-term survival.

They made hard calls, like shutting down divisions that were still profitable. And the most extreme example (from Wikipedia):

In 1994, Vice President Juntarō Suzuki announced that the company would stop paying sōkaiya, a type of protection-racket bribe, to the Yakuza. In retaliation, he was murdered in front of his home by Yakuza.

(To be clear, I’m not suggesting that challenging the Yakuza is a prudent business move.)

Contrast to Kodak: the structure didn’t enable long-term decisions.

There was no founder with a major ownership stake.

No one who'd be around in 20 years to see the results.

Just hired-gun managers optimizing for their tenure.

This is why venture capitalists often only invest in founder-led companies. Founders can and do make bet-the-company decisions. Professional managers usually can't.

So how do you build this into your business?

Structure compensation to include long-term incentives (equity, multi-year bonuses, phantom stock)

Give someone explicit permission to challenge the core business model

Ask yourself: "If I knew this product line would die in 10 years, what would I do today?"

Make sure the role of long-term thinker is protected.

And a final warning: the window for transformation is always shorter than you think. The Fujifilm CEO admitted he got lucky with timing. If he'd waited another year or two, the 2008 recession would have killed them.

—

So that's my take. Kodak's story isn't about executives being stupid. It's about rational people, acting reasonably, inside a structure that made survival impossible.

3 things from this week

Over the holidays, I revisited the rise and fall of Red Lobster. It’s such a wild ride. Here’s my version.

We looked at an energy efficiency business for sale that just kept getting worse. If there’s one thing I don’t want to bet my business on, it’s a gravy train continuing indefinitely.

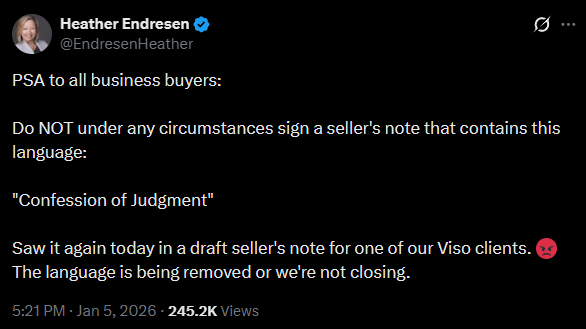

This warning can’t be repeated enough times. More context in the comments.

—

Thanks for reading!

Michael

P.S. Dropping this one more time, in case you forgot:

I’m looking for a CEO Are you an accounting or audit pro who wants to be a CEO? With equity, salary, and reduced downside risk? And more leads than you can handle? I have a founding CEO role available. Reply to this email for more info!

Problem-solve with me.

🌎 STAFFING → Hire with Near. Fortune 500-level talent, at prices any business can afford.

⛷️OWNERS → HoldCo Conference, Feb 9-12, 2026. Where business owners meet, learn, scale and grow at a stunning Utah resort.

💡Q&A → I host regular free lectures on all things business. Coming up:

Jan 20 [RESCHEDULED] — How to Build Winning Remote Teams w/ Franco Pereyra

Jan 23 — How to Incubate Businesses (just me!)

Feb 5 — Buying a Business in 2026 w/ Chelsea Wood

Feb 25 — Small Business AMA (just me!)

💸BUYING A BUSINESS → Acquisitions Anonymous. My podcast where we break down businesses for sale… 440+ episodes in!