Hi everybody,

Last month, I hosted a lecture with my buddy Connor Groce about the different paths to business ownership.

Connor’s done a bunch of franchising, and I’ve done startups and acquisitions, so between us, we had it covered. It turned into a really interesting conversation about tradeoffs, so I thought I’d boil it down for you here.

Connor brought in his take on the paths to entrepreneurship.

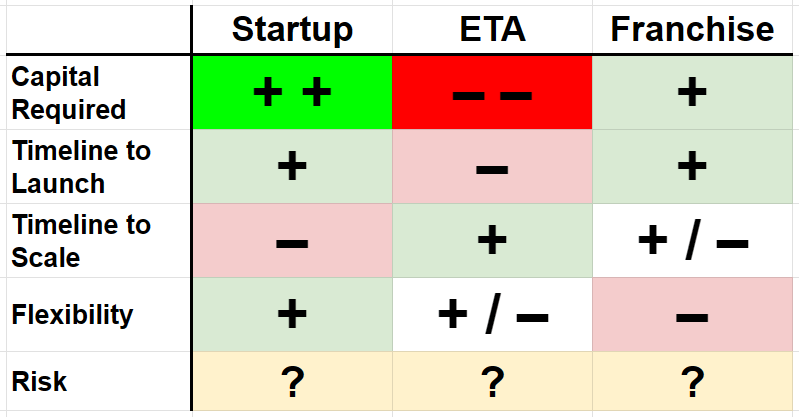

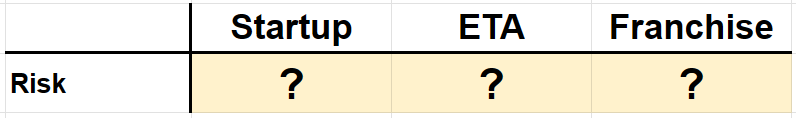

Here’s the gist — and we’ll walk through below.

“ETA = Entrepreneurship Through Acquisition, if you don’t know the lingo”

Before we dive in: HoldCo Conference tickets are going fast. Your ticket covers the conference, room, meals, ski pass, the works. Get yours today.

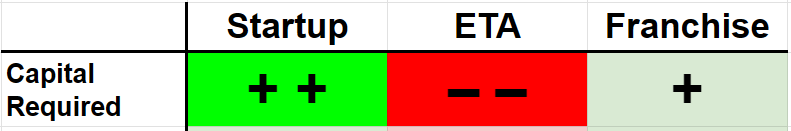

Capital: pay now or pay later

Here's the fundamental trade-off: you can either spend years building or write a check to skip those years.

I've started businesses with $20K (and sometimes less). My preferred method for starting businesses is to experiment with low-risk ideas. It can be insanely capital-efficient, but you have to put in the months or years of stubbing your toe on every mistake.

But buying an established business, you're paying anywhere from 2 to 12 years’ worth of earnings upfront. You’re paying someone else for stubbing their toe, and skipping the zero-to-ten journey.

Franchising sits in the middle. Connor says the good concepts run $150-300K total. (If it’s dirt cheap, it’s probably not worth buying.)

If you want to own a business, your first step is to get honest about your constraints. If you've got capital but no time to build, buying makes sense. If you're broke but willing to grind, start from scratch.

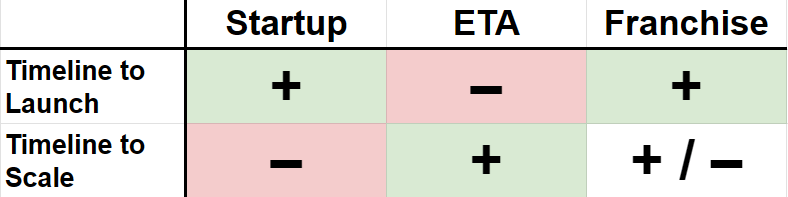

Timeline: the inverse of capital

Timeline can seem unintuitive.

For a startup, you can be “launched” on day one. But, as I mentioned, you have a long road of toe stubbings between you and reaching any kind of scale.

So why is acquisition a minus? Because many people forget the hardest part of buying a business is finding the right business to buy. The actual search is likely to take years.

When you finally find that business, though, ideally you’re walking into revenue, customers, and systems.

Franchising has two interesting tradeoffs here. Connor told me about people he's worked with who spent over two years searching for a business to buy before they gave up and went the franchise route — where the whole search-and-buy process can wrap up in as few as 90 days.

Your ability to scale that franchise, though, depends entirely on which system you buy into. Some brands can fast-track. Others don’t break even for years… or ever. Connor’s take is that 90% of franchises are hot garbage. (Which is why consultants like him exist.)

TOGETHER WITH HIGHLEVEL

HighLevel is the all-in-one CRM that runs your emails, texts, funnels, and more — all in one place.

Think of it as the Swiss army knife for small businesses.

Right now, my readers can get an extended free trial for 30 days by signing up at gohighlevel.com/michaelgirdley.

Already a user? Try out our Unlimited or SaaS PRO tiers.

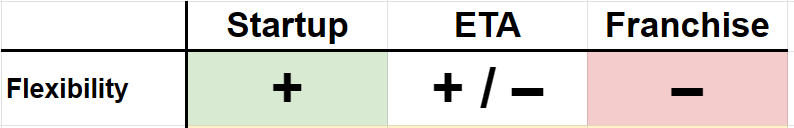

Flexibility

When you buy a business, you inherit someone else's customers, employees, vendor relationships, and problems.

Sure, you have autonomy to change things. But expectations are baked in everywhere. Employees assume "this is how we do things." Customers expect a certain service level. You can't just blow it all up on day one, even if you want to.

Starting from scratch gives you maximum flexibility. No legacy systems, no inherited baggage, no one expecting things to stay the same.

Personally, I like to figure stuff out on my own. I do best when I can improvise, and it’s easier for me to stay interested and excited about something when I’ve built it from scratch.

Other people prefer things to be more prescriptive. This is all subjective.

Risk

Super helpful, right?

All business involves risk. So the choice here is which risks do you want to take.

Starting a business you’re risking time, and maybe some savings. If you do it on the side, you’re risking less money but more time.

Buying a business is obviously a huge financial risk. The stakes can be sky high — if your debt is personally guaranteed, the risk of ruin is very real.

In franchising, the biggest determinant of risk comes down to which brand you buy into. A good franchise has proven systems that reduce your risk. A bad franchise locks you into a failing model with contractual obligations. (Again, that’s why franchise consultants have jobs.)

A note on partners:

Partnerships change the risk equation entirely. I've partnered with dozens of people over the years. I've had three bad partners out of several dozen, and they were horrible. They made everything not fun.

So if you're bringing on a partner, whether it’s a startup, acquisition, or franchise, make sure they're contributing capital, skills, or strategic value. Ideally all three.

Also: have a prenup. Deal with the non-zero chance things go sideways before they actually go sideways.

(If you’re considering a partnership, read my article on how I look for great business partners.)

The bottom line on risk: You can't generalize. Look at your specific situation and ask: what am I actually risking here, and can I afford to lose it?

—

That’s all for now. If you’re interested in watching the whole lecture, plus the Q&A we did afterwards, you can catch it here.

If franchising sounds interesting, check out Connor’s newsletter for lots of great intel on that.

A QUICK NOTE FROM CONNOR

Now that Girdley’s summed up the tradeoffs, you need to figure out which ones actually matter for your situation.

If you’re serious about an acquisition, and franchising is on your radar, I can help you cut through the noise. We'll figure out if it's the right path for you, and if so, which brands are worth your time.

No pitch. No pressure. Just a strategy conversation.

3 things from this week

Appetizer: We’re running some greatest hits on Acquisitions Anonymous over the holidays — this week we hit the Worm Farm (which we all loved) and the Pizza Boat (Bill’s dream business). Give them a listen!

Main: I drove a DeLorean for a while. It was a marketing gimmick… or at least, “marketing gimmick” was my excuse. So I got to stick some of my own photos and video clips in my latest YouTube video: The rise and fall of DeLorean Motor Corporation.

Note the height differential. (my pics at 6:28)

Dessert: Where’s your California?

Which path are you considering? What trade-offs are keeping you up at night?

Thanks for reading!

Michael

P.S. Catch my upcoming lectures when we go live! The whole schedule is right here.

Problem-solve with me.

🌎 STAFFING → Hire with Near. Fortune 500-level talent, at prices any business can afford.

⛷️OWNERS → HoldCo Conference, Feb 9-12, 2026. Where business owners meet, learn, scale and grow at a stunning Utah resort.

💡Q&A → I host regular free lectures on all things business. Coming up:

Jan 9 — How to Build Winning Remote Teams w/ Franco Pereyra

Jan 23 — How to Incubate Businesses (just me!)

Feb 5 — Buying a Business in 2026 w/ Chelsea Wood

Feb 25 — Small Business AMA (just me!)

💸BUYING A BUSINESS → Acquisitions Anonymous. My podcast where we break down businesses for sale… 440+ episodes in!